n today's complex compliance landscape, Segregation of Duties (SoD) remains a cornerstone of...

How to Effectively Prioritize Your Internal Control Plan with Limited Staff

With limited resources and growing demands, audit and internal control teams must rethink their approach. This methodology helps you maximize the impact of your controls by focusing on the risks that truly matter.

The Complex Equation of Internal Audit & Control : Doing More with Less

Internal audit and control departments face a complex equation: regulatory requirements intensify, risks diversify, yet teams remain limited and budgets constrained as the IFACI benchmarked. Add to this an inescapable reality: data and transaction volumes continue to grow exponentially, making exhaustive coverage an illusion. The solution lies in intelligent prioritization that maximizes the impact of each control while providing sufficiently broad and varied coverage to effectively mitigate your risks.

The Art of Prioritization: Identifying True Risk Zones

Effective prioritization begins with a deep understanding of your risk ecosystem. This goes well beyond theoretical mapping. It's about identifying where your organization's real vulnerabilities hide – those that could truly hurt if materialized.

Major financial flows naturally provide an obvious starting point. If 80% of purchases go through twenty suppliers, it makes sense to concentrate controls on these critical relationships rather than treating all third parties uniformly. This financial mass approach covers essential risk with a fraction of the effort.

But prioritization doesn't stop at amounts. Organizational aspects play a crucial role in risk emergence. A recently acquired subsidiary with non-integrated systems, heterogeneous processes, and different culture mechanically presents more risks than a mature, perfectly integrated entity. Similarly, a team with high turnover or junior management requires special attention, regardless of amounts managed.

Geographic dimension adds another layer of complexity. Operating in high-risk countries, according to international corruption indices, requires enhanced controls on certain processes, particularly third-party relationships and payments.

From Gross to Net Risk: KRIs as Your Compass

The Static View of Gross Risk and Its Limitations

Many organizations still define their control needs based on gross risk – the worst-case scenario without protection. Result can be: overinvesting in already well-controlled areas while underestimating real vulnerabilities.

While net risk, which accounts for existing control effectiveness, offers a more practical and operational view of actual exposure, this vision remains static if not continuously updated.

KRIs: Transforming Data into Decisions

This is where Key Risk Indicators (KRIs) come into play: they don't directly measure net risk but track its concrete manifestations. True radars of the control framework, they detect weak signals and focus control efforts on areas genuinely under stress.

The most useful KRIs are often remarkably simple:

- Extended validation delays indicate a weakened process

- Proliferation of post-closing entries reveals governance or system failures

- High unmatched payment rates signal degraded accounting quality

- Inventory variances concentrated at certain sites point to localized failures

Comparative Analysis for Effective Prioritization

The real power of KRIs lies in comparative analysis. Monitoring indicators month-over-month reveals concerning trends. But it's especially the comparison between similar entities that reveals anomalies. Why does one subsidiary consistently show KRIs three times higher? These objective gaps immediately point to priority areas.

This approach transforms prioritization from a theoretical exercise into fact-based decision-making. Entities with the most degraded KRIs naturally become priorities for an audit mission, for example, regardless of their size or history. It's dynamic prioritization that continuously adapts to operational reality.

Cross-Functional Controls: Detecting Invisible Patterns

Combined Analysis of Weak Signals

While traditional controls examine each element in isolation, cross-functional analysis crosses weak signals to reveal otherwise invisible risk patterns.

Take a concrete case: your company processes thousands of invoices monthly. A $9,950 invoice from supplier "ABC Ltd" passes all standard individual controls. Purchase order present, three-way match respected, no duplicates detected. Everything appears compliant.

Revelation Through Anomaly Crossing

But transverse analysis reveals another story. The same user entered the order and validated receipt, breaking segregation of duties. Payment terms were reduced to 8 days instead of contractual 30 days. Bank details were modified two days before. The entry was posted during the weekend.

Individually, each signal could be considered low risk. But crossing these four anomalies together on a single transaction completely changes the picture. This invoice suddenly becomes highly suspect and priority for investigation.

Efficiency Gains for Limited Teams

The transverse approach thus accelerates detection. Instead of drowning teams under isolated low-criticality alerts, it surfaces real risk situations by automatically crossing SoD, accounting data, vendor files, and temporal patterns.

This ability to see invisible connections between different compliance domains represents a major efficiency gain. A single well-designed transverse control can replace dozens of unit checks.

Intelligent Sampling: Optimizing Coverage

Risk-Based Sampling Depth

Faced with the impossibility of controlling everything, sampling becomes strategic. The traditional random approach no longer suffices: you need intelligent risk-based sampling.

A mature process with green KRIs can make do with quarterly control on a small percentage. Conversely, focus efforts on at-risk populations. If 80% of anomalies come from transactions over $10,000, focus sampling on this bracket.

Stratifying by Volume

For thousands of daily transactions, adopt a stratified approach: exhaustive control above critical threshold, enhanced sampling for middle range, minimal for small amounts.

Sampling also adapts over time. A new process warrants temporary over-sampling. To go deeper on this methodology and meet regulatory requirements, see our guide on intelligent sampling for anti-corruption controls according to regulatory recommendations. Because it doesn’t have to be complex, sampling can also be automated.

Quick Wins: Demonstrating Value Rapidly

In transforming your control approach, quick wins play a crucial psychological role. These rapid, visible improvements create buy-in, maintain change momentum, and justify future investments.

- Duplicate invoices and overpayment recovery: Simple control generating immediate, measurable savings. Automated detection not only recovers double payments but prevents recurrence.

- Price and margin variance control: Analysis of abnormal sales price or margin variations quickly reveals input errors, unauthorized discounts, or fraud/corruption patterns. Prices significantly below standard warrant immediate investigation.

- Inventory optimization: Controls on inventory variances and scrap rates identify avoidable material losses (process failures) or suspicious ones (misappropriation), plus inefficiencies directly impacting operating margin.

With a few key controls, you concretely demonstrate internal control ROI and transform your function into a true business partner. To deepen this approach, discover our complete article on how to demonstrate ROI.

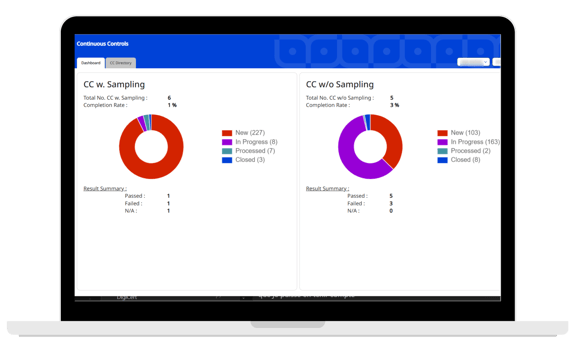

Centralizing and Automating Tracking: Moving Beyond Manual Processes

Efficiency Through a Single Repository

Modern internal audit and control framework management can no longer rely on email tracking and scattered Excel files. This manual approach consumes precious time.

A centralized tool transforms operational efficiency by grouping all controls, results, anomalies, and action plans in a single repository. Automated workflows notify the right people at the right time. Dashboards update dynamically.

Traceability and Audit Preparation

Complete traceability becomes native: who did what, when, with what result. This exhaustive audit trail meets regulatory requirements and seamlessly prepares for external audits. Regulators particularly appreciate this ability to quickly justify each decision.

This centralization also breaks down silos. Auditors, controllers, and operations share the same updated view. Time saved on administration is reinvested in value-added analysis.

Conclusion: A Necessary and Accessible Transformation

Effective prioritization with limited teams isn't a compromise on control quality. It's an evolution toward greater maturity and intelligence in resource allocation. Organizations succeeding in this transformation find they better control critical risks while freeing time for analysis and advisory.

This approach isn't reserved for large organizations with significant resources. On the contrary, it's precisely when resources are limited that prioritization intelligence makes the difference. With clear methodology, appropriate tools, and willingness to change, any internal control team can transform its practice.

One final piece of advice: the trap to avoid is paralyzing perfectionism preventing you from starting. Waiting for the perfect system, ideal methodology, or unanimous buy-in guarantees immobility. Better an imperfect but evolving approach than theoretical perfection never implemented.

Modern internal control is no longer measured by the number of controls performed but by impact on risks that truly matter. This new model transforms the function from cost center to value-creating partner.

Ready to multiply your small team's impact? Request your personalized demo of Eye2Scan.