Anti-corruption accounting controls sampling represents a critical challenge for internal audit and...

Compensating Controls for Segregation of Duties: Safeguarding Your Transaction Processes

n today's complex compliance landscape, Segregation of Duties (SoD) remains a cornerstone of effective internal control frameworks. Yet the reality most organizations face is stark: achieving perfect SoD implementation is virtually impossible. This permanent, unavoidable risk can't be eliminated—instead, it must be managed strategically.

The financial stakes couldn't be higher. According to the Association of Certified Fraud Examiners (ACFE), inadequate internal controls contribute to over 50% of corporate fraud cases, costing organizations approximately 5% of their annual revenue. This is precisely where compensating controls become invaluable, serving as critical safety nets when strict separation of responsibilities can't be fully achieved.

This article explores why these compensating controls have become essential components of a robust control environment and provides practical guidance for implementing them effectively in your organization.

Understanding Segregation of Duties and Its Limitations

Segregation of Duties is built on a straightforward principle: no single individual should control an entire process from start to finish. By dividing key responsibilities (such as transaction creation, approval, and recording) among different employees, organizations significantly reduce fraud risk and minimize errors.

However, several real-world constraints make perfect SoD implementation challenging:

- Limited resources: Many departments simply don't have enough staff to properly separate all critical functions

- Role evolution: As employees change positions or take on additional responsibilities, segregation conflicts inevitably emerge

- System implementations: During ERP migrations or new application rollouts, user profiles often receive overly broad access rights that remain unreviewed

- System complexity: Mapping all transactions and their interactions across sophisticated enterprise systems presents substantial difficulties

- High transaction volumes: The sheer volume of data makes comprehensive analysis impossible without specialized tools

The bottom line? No organization can realistically achieve 100% perfect segregation of duties. The key is learning to manage this inherent risk effectively through strategic compensating controls.

Why Compensating Controls Are Critical for Your Control Environment

Compensating controls specifically address the inevitable gaps in segregation of duties. Unlike theoretical user access reviews that only identify potential risks based on assigned permissions, compensating controls verify whether those risks have actually materialized by analyzing transactions that have already occurred in your systems.

Six Reasons SOD Compensating Controls Are Essential

- They provide actual evidence: While access reviews identify theoretical risks, compensating controls demonstrate whether conflicts have been exploited in practice. As KPMG has noted, these controls significantly reduce human error risk and strengthen process integrity across complex operations..

- They create powerful deterrence: The mere existence of effective compensating controls discourages potential fraud attempts—employees are less likely to exploit access conflicts when they know transactions are being monitored.

- They enable business continuity: Compensating controls provide the necessary assurance to continue operations even when perfect segregation isn't feasible, balancing risk management with operational efficiency.

- They extend beyond standard accounting reviews: Effective compensating controls go beyond basic journal entry analysis by correlating information across multiple systems and data sources.

- They flag suspicious patterns: These controls can identify specific operational red flags such as unusual transaction timing, abnormal processing volumes, or suspicious activity patterns that wouldn't be detected through standard reviews.

- They support regulatory compliance: Compensating controls align naturally with key compliance frameworks including Sarbanes-Oxley (SOX), FCPA requirements, and industry standards like COSO.

Implementing Effective Segration of Duties Compensating Controls: A Practical Approach

For maximum effectiveness, compensating controls require thoughtful implementation and should address several key requirements:

1. Look Beyond Basic Journal Entry Analysis

Strong compensating controls must go deeper than reviewing general ledger entries. They should integrate multiple data sources and establish meaningful correlations that reveal potential issues. This comprehensive approach requires:

- Creating sophisticated data relationships between disparate system tables

- Processing and analyzing high-volume transaction datasets

- Connecting activity across multiple applications and platforms

2. Focus on High-Risk Transaction Cycles

Your compensating controls should prioritize the most critical business processes where fraud risk is highest:

- Procure-to-Pay (P2P): From purchase requisition through vendor payment

- Order-to-Cash (O2C): From customer order through payment collection

- Record-to-Report (R2R): From journal entries through financial statement preparation

Real-World Example: Compensating Controls in Procure-to-Pay (P2P)

A classic risk scenario occurs when an employee can both create vendor master records and approve payments. An effective compensating control might:

- Regularly analyze all newly created vendor records

- Identify vendors who received payments approved by the same person who created their record

- Examine these transactions in detail to verify legitimacy

- Flag activity occurring during unusual hours (evenings, weekends) for additional review

3. Distinguish Between Access Types in Your Control Framework

When designing controls, differentiate between:

- Sensitive access: Activities like payment processing that pose risk but don't necessarily create segregation conflicts

- Conflicting transaction access: Combinations that violate SoD principles, such as when a single user can create purchase orders and record goods receipt

This distinction is fundamental to designing targeted, effective controls.

4. Address Implementation Challenges Proactively

Organizations frequently encounter several obstacles when implementing compensating controls:

- Technical complexity: Extracting and correlating relevant data requires specialized expertise rarely available in-house

- Tool limitations: Many existing solutions focus primarily on access controls without providing advanced transaction analysis capabilities

- Maintenance requirements: Controls must be regularly updated to reflect system changes and evolving business processes

Eye2Scan: Comprehensive SoD Compensating Controls Solution

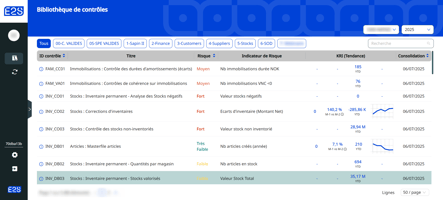

Eye2Scan delivers an innovative platform specifically designed for implementing transaction-focused compensating controls that go beyond traditional access reviews. Our solution:

controls that go beyond traditional access reviews. Our solution:

- Monitors actual transaction activity: We continuously identify users performing unusual operations or actions that conflict with their assigned authorizations

- Detects suspicious behavior patterns: Our system automatically flags users creating entries during atypical hours or generating abnormally high transaction volumes

- Analyzes transaction sequences: The platform identifies suspicious patterns that may indicate fraud attempts

- Generates actionable insights: Our visualization tools and dashboards help teams quickly prepare compliance documentation and streamline audit processes

The Eye2Scan Advantage for SoD Compensating Controls

- Seamless integration: Native connections with your ERP environment without requiring complex development

- Business user empowerment: Designed for finance, audit, and compliance teams to use independently without IT department involvement

- Continuous monitoring: Provides ongoing surveillance rather than periodic sampling

- Comprehensive visibility: Cross-references data across various system tables for precise anomaly detection

Conclusion: Strengthen Your Control Environment with Effective SoD Compensating Controls

Compensating controls aren't merely a fallback solution when perfect segregation of duties proves unattainable—they represent a fundamental component of a mature internal control strategy. By moving beyond theoretical risks to verify whether potential conflicts have actually been exploited, these controls provide crucial additional assurance.

In today's business environment, where fraud threats continue to evolve in sophistication, these controls serve as an essential safety net that allows organizations to operate efficiently while effectively managing operational risks. As our CEO often reminds clients, "No organization is bulletproof"—but with well-designed compensating controls, you can substantially strengthen your defenses against fraud and significantly improve your overall control posture.